Practical help for the poorest of the poor

Analysis by columnist Don Cayo

Well conceived, well delivered micro-credit is akin to a miracle drug. It routinely works wonders for many of the billions world-wide who are afflicted by poverty.

But, like virtually every drug, it doesn’t work for all. And for some — for those mired so deep in poverty that they can’t carry even a tiny debt load — it can have nasty side-effects. Micro-credit agencies are increasingly aware of the danger to some clients who may come under immense pressure — perhaps ostracized by neighbours, or even driven to suicide — because they can’t repay what they never should have borrowed.

like virtually every drug, it doesn’t work for all. And for some — for those mired so deep in poverty that they can’t carry even a tiny debt load — it can have nasty side-effects. Micro-credit agencies are increasingly aware of the danger to some clients who may come under immense pressure — perhaps ostracized by neighbours, or even driven to suicide — because they can’t repay what they never should have borrowed.

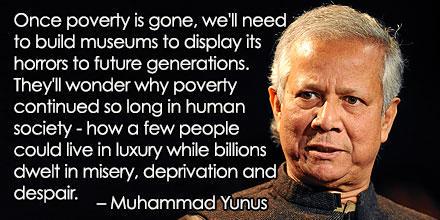

“When it comes to people who earn less than a dollar a day (and they number about a billion), micro-credit doesn’t work,” says Joanna Ledgerwood, a former Canadian banker and former associate of Nobel peace prize winner Muhammad Yunus who now works for the Aga Khan Development Network based from Geneva.

So it may astonish you that many of these people who are too poor to borrow can, with a little help, actually save their own money in amounts sufficient to tide them through extraordinary expenses such as annual school fees and/or family emergencies.

That’s the premise of Village Savings and Loan Associations that Ledgerwood is spending a lot of time working on these days. Aga Khan workers assist villages in remote and profoundly poor parts of the world to set up their own savings groups — as little as five cents a week — and to manage their own finances.